Payroll Tally Step by Step Notes with Assignment for Training of Tally ERP 9 and Tally Prime. Tally Training Study Notes for Self study and Teachers of Tally Training Computer Course.

Step by Step Payroll Tally Notes

F11 -> Accounting Features

Maintain Payroll – Yes

Maintain more than one payroll or cost category – Yes

Create Employees Category

GOT -> Payroll Info -> Employees Category -> Create

Head Office

Regional Office

Allocate Revenue Items – Yes

Create Employees Group

GOT -> Payroll Info -> Employees Group -> Create

Category – Head Office

Category Name – Marketing

Under – Primary

Define salary details – No

Create below given employees groups:-

- Marketing

- Sales

- Account

- HR

Create Units (Work) : Payroll Tally Notes

GOT ->Payroll Info -> Units (work)

Create

Type : Simple

Symbol : Hrs

Name : hours

Type : Simple

Symbol : Min

Name : Minutes

Type : Simple

Symbol : Days

Name: Number of Days

Type : Compound

First Unit : Hrs, Conversion -60, Second unit : Min

Type : Compound

First Unit : Days, Conversion -8, Second unit : Hrs

Check in display

Create Attendance / Production Type

GOT->Payroll info-> Attendance

Create

Name : Present

under : Primary

Attendance type : Attendance / Leave with pay

Name : Overtime

under : Primary

Attendance type : Production

Unit : Compound ( Day of 8 hrs)

Display

Payroll Tally Notes for Training Purpose

Pay Heads in Tally Payroll

GOT->Payroll info-> Pay Heads

Create

Name : Basic Pay

Pay Head Type: Earning for Employees

Income Type : Fixed

Under : Indirect Expenses

Affect Net Salary : Yes

Use for Calculation of Gratuity : Yes

Calculation Type : On attendance

Attendance with Pay : Present

Calculation Period : Months

Basis of calculation : As per calendar period

Rounding Method : Normal rounding

Name : HRA

Pay Head Type: Earning for Employees

Income Type : Fixed

Under : Indirect Expenses

Affect Net Salary : Yes

Use for Calculation of Gratuity : No

Calculation Type : As computed value

Rounding Method : Normal rounding

Computation Info

Compute : On specific Formula

Add Pay Head : Basic Pay

Slab Type : Percentage

Value : 20 %

Name : DA

Pay Head Type: Earning for Employees

Income Type : Fixed

Under : Indirect Expenses

Affect Net Salary : Yes

Use for Calculation of Gratuity : No

Calculation Type : As computed value

Rounding Method: Normal rounding

Computation Info

Compute : On specific Formula

Add Pay Head : Basic Pay

Slab Rate : Percentage

Value : 40 %

Transport Allowance

Pay Head Type: Earning for Employees

Income Type : Fixed

Under : Indirect Expenses

Affect Net Salary : Yes

Use for Calculation of Gratuity : No

Calculation Type : As computed value

Rounding Method: Normal rounding

Computation Info

Compute : On specific Formula

Add Pay Head : Basic Pay

Slab Rate : Percentage

Value : 10 %

Name : Bonus

Pay Head Type: Earning for Employees

Income Type : Fixed

Under : Indirect Expenses

Affect Net Salary : Yes

Use for Calculation of Gratuity : No

Calculation Type : Flat Rate

Calculation Period: Monthly

Name : PF Employer

Pay Head Type: Employer’s statuary contribution

Statuary Pay Type : PF Account

Statuary Pay Type : PF Account

Under : Indirect Expenses

Affect Net Salary : Yes

Calculation Type : As computed value

Rounding Method : Normal rounding

Computation Info

Compute : On specific Formula

Add Pay Head : Basic Pay

Slab Rate : Percentage

Value : 12%

Name : ESIC Employer

Pay Head Type: Employer’s statuary contribution

Statuary Pay Type : Employee State Insurance

Under : Indirect Expenses

Affect Net Salary : Yes

Calculation Type : As computed value

Rounding Method : Normal rounding

Computation Info

Compute: On current Sub-total

Slab Rate: Percentage

Value : 3.25%

Name : PF Employee

Pay Head Type: Employee’s statuary deduction

Under : Current Liability

Affect Net Salary : Yes

Calculation Type : As computed value

Rounding Method : Normal rounding

Computation Info

Compute : On specific Formula

Add Pay Head : Basic Pay

Slab Rate : Percentage

Value : 12%

Name : ESIC Employee

Pay Head Type: Employee’s statuary deduction

Under : Current Liability

Affect Net Salary : Yes

Calculation Type : As computed value

Rounding Method : Normal rounding

Computation Info

Compute: On current Sub-total

Slab Rate: Percentage

Value : 0.75%

Name : Over Time

Pay Head Type: Earning for Employees

Income Type : Fixed

Under : Indirect Expenses

Affect Net Salary : Yes

Use for Calculation of Gratuity : No

Calculation Type : On production

Production type : Over time

Note : Over time rate to be filled for each employees at salary details

Employees

GOT -> Payroll Info -> Employees -> Create

Single Employee

Employee Creation Window

Category : Head Office

Name : Ajay Gulia

Under : Marketing

DOJ : 1st April 2021

Define Salary Details : Yes

Salary Detail Window

Pay Head

Basic Pay : 20000

DA:

HRA:

TA :

Bonus : 1000

Overtime : 50 ( Rate )

PF Employer

PF Employee

ESIC Employer

ESIC Employee

Employee Number : M001

Designation : Manager

Function : Marketing Management

Location : Delhi

Gender : Male

DOB : 01-April-1990

Blood Group : A Positive

Father Name : Rohit Saxena

Spouse Name : Reena

Address : Shernagar, Muzaffarnagar

Phone Number : 9876543433

e-mail : xyz@gmail.com

Provide Bank Detail – Yes

Bank Details window appear

Account Number : 123456767788

IFSC code: ABCD0123456

Bank Name : Specify Bank Name

Bank Name : State Bank of India

Transaction Type : e-fund transfer

PAN Number : ASDFG1234C

Aadhar number :1234567891234567

PF Account number : ABCD11334

PRAN : 576778788

ESI NUMBER : 5654433

ESI DISPENSARY : DELHI

CTRL + A

GOT->Payroll Info ->Employees -> Single employee -> Display

GOT -> Payroll Info -> Employees

Create

Category : Head Office

| Name | Under | Basic Pay | Bonus | Overtime | Emp Number | Designation |

| Sunil Saini | Account | 20000 | 1500 | 100 | A001 | Manager |

| Irfan | Account | 22000 | 1000 | 50 | A002 | Clerk |

| Ajay Kumar | HR | 25000 | 1000 | 80 | H001 | Head |

| Ravi Raj | HR | 15000 | 1000 | 70 | H002 | Executive |

| Sameer | Marketing | 9000 | 1000 | 45 | M001 | Manager |

| Jyoti Tyagi | Marketing | 11000 | 000 | 30 | M002 | Executive |

| Payal | Marketing | 12000 | 1000 | 40 | M003 | Clerk |

| Rajesh Chauhan | Sales | 25000 | 2000 | 50 | S001 | GM |

| Sunita | Sales | 15000 | 1000 | 45 | S002 | Manager |

| Sumit Sinha | Sales | 10000 | 1000 | 60 | S003 | Clerk |

| Sabu Mahato | Sales | 8000 | 1000 | 50 | S004 | Salesman |

| Shivam | Sales | 8500 | 1000 | 50 | S005 | Salesman |

| Raveena | Sales | 8000 | 1000 | 50 | S006 | Salesman |

| Ankur Jha | Sales | 9000 | 500 | 50 | S007 | Salesman |

| Anup Kumar | Sales | 9200 | 1000 | 50 | S008 | Salesman |

Payroll Vouchers

GOT ->Transactions ->Payroll Vouchers

Attendance Boucher Creation

Change Voucher Date 31 -05-2021

Ctrl + F4 (Payroll) ->ctrl+F5 (attendance) -> Alt A Attendance Auto fill)

Attendance Auto Fill Window

Voucher Date : 31-05-2021

Employee Category : Head Office

Employees Group : All Group

Attendance Type : Present

Default value : 0

Sort by : Employees Name

Fill the value : Number of Present days for each individual

Repeat for attendance type : Overtime

Payroll Boucher Creation

Ctrl F4 (Payroll) -> Alt A (Payroll Auto fill)

Payroll Autofill window

Process for : Salary

From : 01-05-2021

To: 31-05-2021

Employees Category : Head Office

Employees Group : All Items

Sort by : Employees Name

Payroll Ledger : Cash

Include Emp Bank details : Yes

Accept

Display the Salary Information

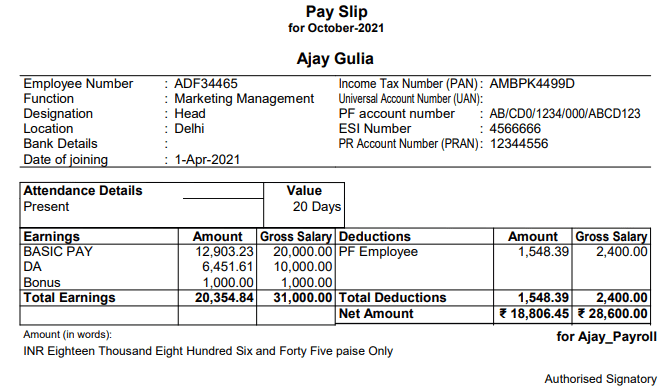

GOT -> Display ->Payroll reports -> statements of Payroll -> Payslip ->Single Payslip

Select the name for Pay slip of Individual

Thanks for read the Payroll Tally Notes with Computer Course Training Assignment for practice