Tally Prime with GST Course Notes with Example. Step by Step Guide for GST implementation, create CGST, SGST, IGST ledgers, Sample Purchase and Sales entry with GST. Computer Training Institute Notes with practice assignment PDF is very useful for learners.

GST (Goods and Service Tax)

CGST – Centre Goods and Service Tax

SGST – State Goods and Service Tax

IGST – Integrated Goods and Service Tax

GST Rates slab in India

- Nil

- 5%

- 12%

- 18%

- 28%

Tally Prime Course Notes with GST : Step by Step Guide

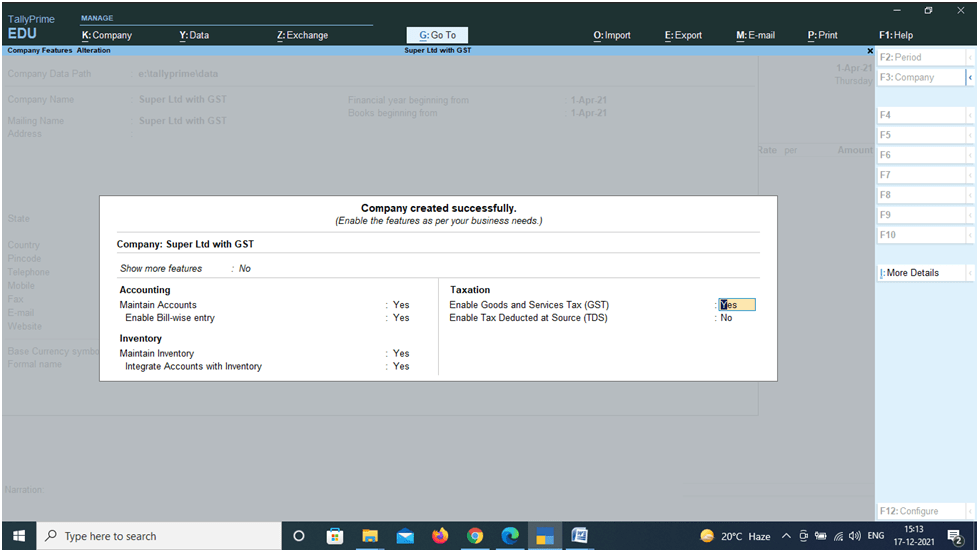

Open New Company : F3 Company >Create Company

Activate GST in Tally Prime

Taxation

Enable Goods and Service Tax (GST): Yes

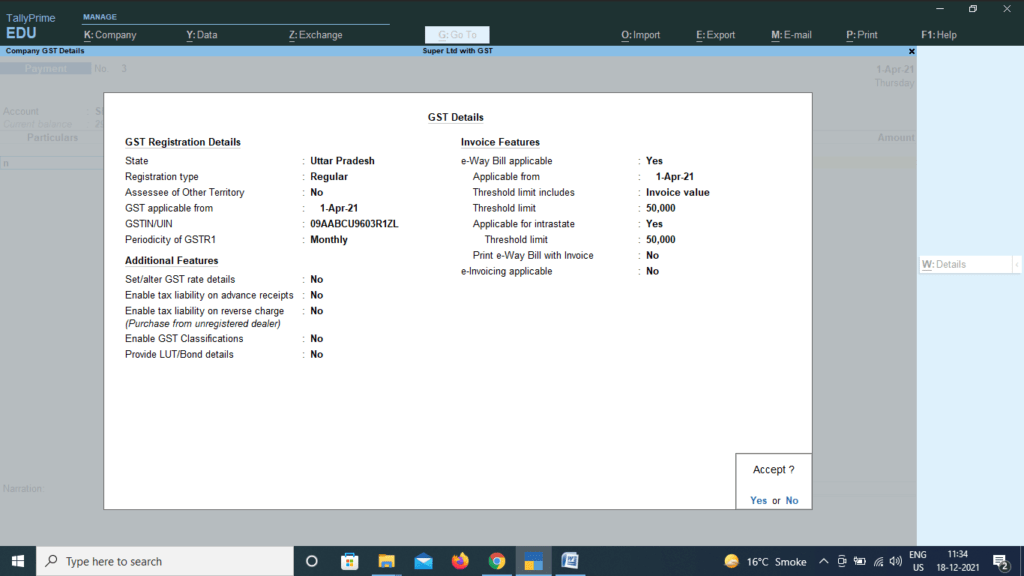

GST Details State : Uttar Pradesh

Reg Type : Regular

GSTIN : 09AABCU9603R1ZL

Periodicity : Monthly

Accept GST details and Accept Statutory and Taxation

Create GST Ledgers in Tally Prime

Gateway of Tally > Create > Ledgers

CGST

Name : CGST

Under : Duties and Taxes

Type of Tax : GST

Tax Type : Central Tax

SGST

Name :SGST

Under : Duties and Taxes

Type of Tax : GST

Tax Type : State Tax

IGST

Name :IGST

Under : Duties and Taxes

Type of Tax : GST

Tax Type : Integrated Tax

Purchase

Under : Purchase Account

GST Details : Applicable

Type of Supply : Goods

Sales

Under :Sales Account

GST Details : Applicable

Type of Supply : Goods

SBI Bank

Under : Bank Account

Ledger for Purchase Party

Super Computer Store

Under : Sundry Creditors

State : Uttar Pradesh

Reg Type : Regular

GSTIN : 09AABCD1203R1ZL

Set Alt GST details : No

Delhi Computer Traders

Under : Sundry Creditors

State : Delhi

Reg Type : Regular

GSTIN : 09AABCD1203R1ZL

Set Alt GST details : No

Ledger for Sales Party

Sudhir Saini

Under : Sundry Debtors

Set Alt GST details : No

State : Uttar Pradesh

Sanju Rawat

Under : Sundry Debtors

Set Alt GST details : No

State : Uttarakhand

Stock Group Creation : Gateway of Tally> Create > Stock Group

Computer Parts

Under : Primary

Set / Alt GST : No

Note: If all the items of a group have same GST rate, than GST rates can be set for groups. But for training purpose, we will set GST rate for each individual items.

Create Unit : Gateway of Tally> Create > Stock Units

Symbol : Pcs

Name : Pieces

Create Stock Items with GST Rates in Tally Prime

Gateway of Tally> Create > Items

Keyboard –Dell

Under : Computer Parts

Unit : Pcs

GST : Applicable

Set/Alter GST : Yes

Calculation Type : On Value

Taxability : Taxable

Tax Type : Integrated : 18%

Type of Supply : Goods

Keyboard – HP

Under : Computer Parts

Unit : Pcs

GST : Applicable

Set/Alter GST : Yes

Calculation Type : On Value

Taxability : Taxable

Tax Type : Integrated : 18%

Type of Supply : Goods

Mouse (Normal)

Under : Computer Parts

Unit : Pcs

GST : Applicable

Set/Alter GST : Yes

Calculation Type : On Value

Taxability : Taxable

Tax Type : Integrated : 18%

Type of Supply : Goods

Mouse (Cordless)

Under : Computer Parts

Unit : Pcs

GST : Applicable

Set/Alter GST : Yes

Calculation Type : On Value

Taxability : Taxable

Tax Type : Integrated : 18%

Type of Supply : Goods

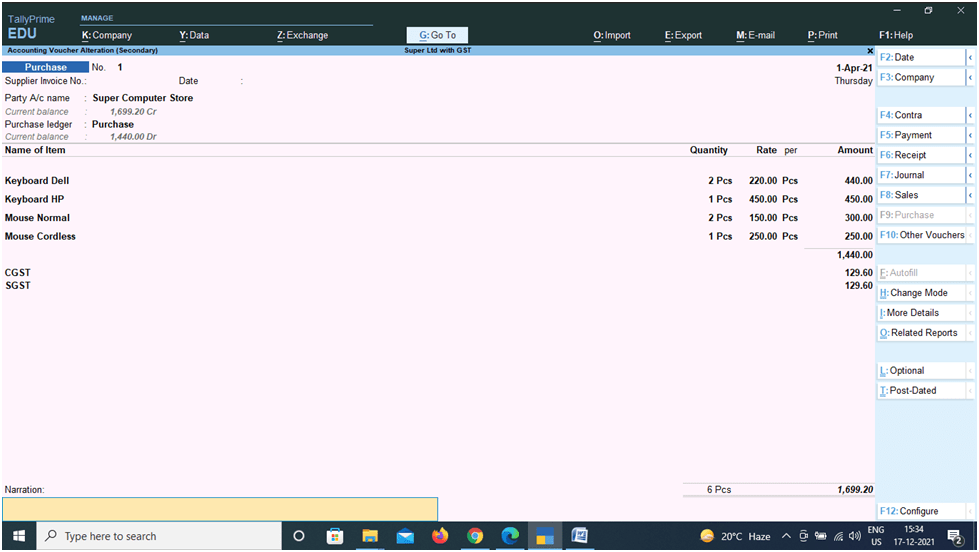

Purchase the Items with GST in Tally Prime

Purchase with in State: CGST and SGST Applicable

Gateway of Tally > Voucher > F9 (Purchase)

Party Account : Super Computer Store

| Items | Quantity | Rate | Amount |

|---|---|---|---|

| Keyboard – Dell | 2 Pcs | 220 | 440 |

| Keyboard – HP | 1 Pcs | 450 | 450 |

| Mouse – Normal | 2 Pcs | 150 | 300 |

| Mouse – Cordless | 1 Pcs | 250 | 250 |

| SGST | 129.60 | ||

| CGST | 129.60 |

Enter and Accept:

Our company is Registered in Uttar Pradesh and supplier Super Computer Store is also from Uttar Pradesh (Same State). Therefore, CGST and SGST are applicable.

Screen Shot is shown below:

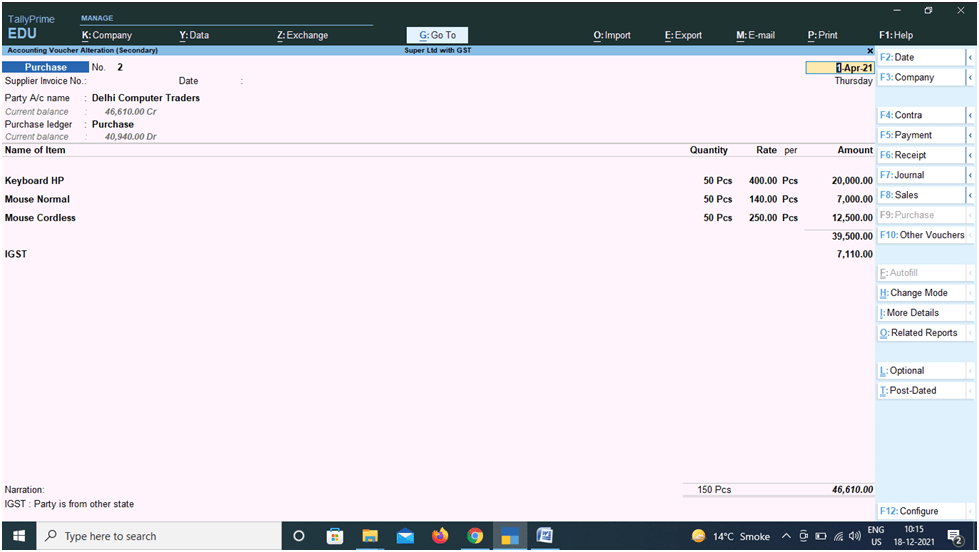

Purchase from Other State : IGST Applicable

Gateway of Tally > Voucher > F9 (Purchase)

Party Account : Delhi Computer Traders

| Items | Quantity | Rate | Amount |

|---|---|---|---|

| Keyboard – HP | 50 Pcs | 400 | 20000 |

| Mouse – Normal | 50 Pcs | 140 | 7000 |

| Mouse – Cordless | 50 Pcs | 250 | 1250 |

| IGST | 7110.00 | ||

| 150 Pcs | 46610.00 |

Our company is Registered in Uttar Pradesh and supplier Delhi Computer Trader is from Delhi (Other State). Therefore, IGST are applicable, in place of SGST and CGST.

Screen Shot is given below:

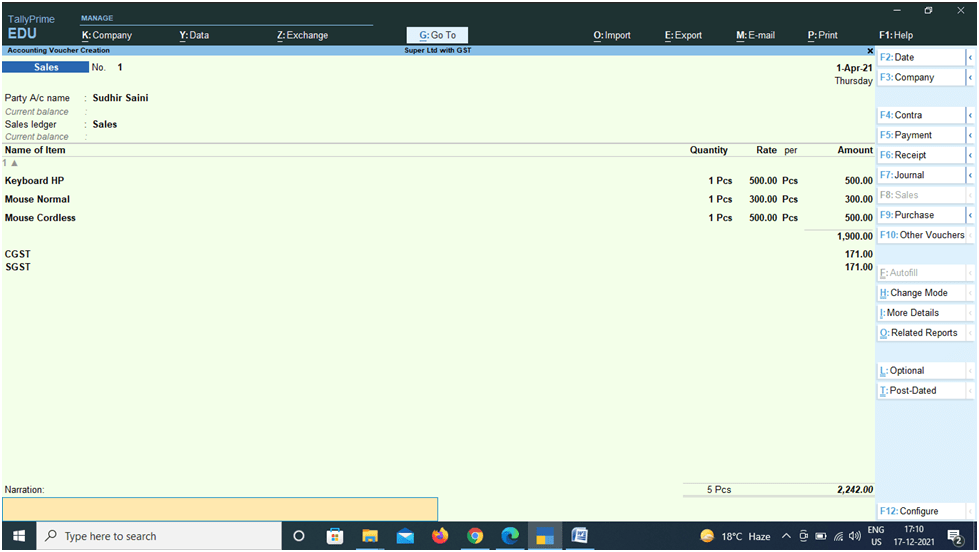

Sales the Items: with in State : CGST and SGST Applicable

GOT > Account Voucher > F8 (Sales)

Party Account : Sudhir Saini

| Items | Quantity | Rate | Amount |

|---|---|---|---|

| Keyboard – Dell | 2 Pcs | 300 | 600 |

| Keyboard – HP | 1 Pcs | 500 | 500 |

| Mouse – Normal | 1 Pcs | 300 | 300 |

| Mouse – Cordless | 1 Pcs | 500 | 500 |

| SGST | 171 | ||

| CGST | 171 |

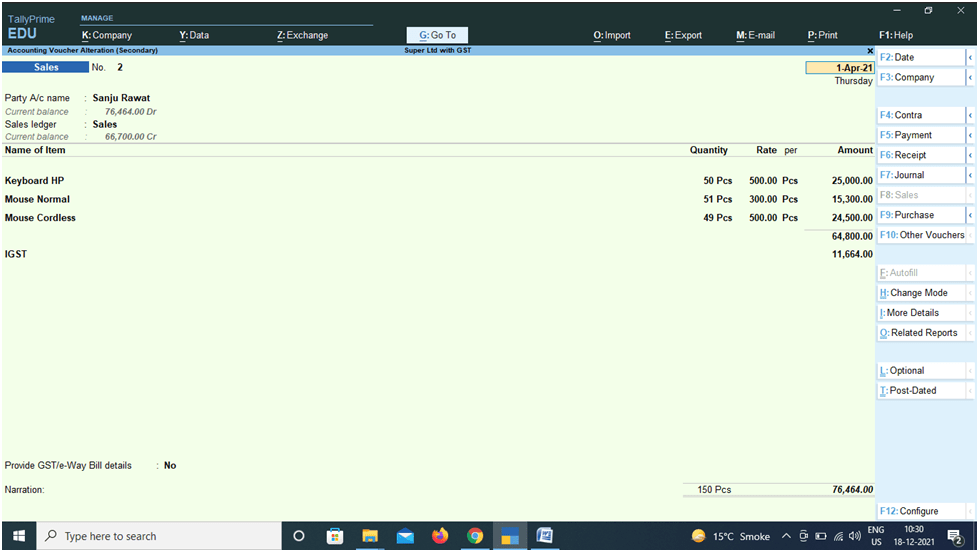

Sales the Items: Other State : CGST and SGST Applicable

GOT > Account Voucher > F8 (Sales)

Party Account : Sanju Rawat (Uttarakhand)

Sales Ledger : Sales

| Items | Quantity | Rate | Amount |

|---|---|---|---|

| Keyboard – HP | 50 Pcs | 500 | 25000 |

| Mouse – Normal | 51 Pcs | 300 | 15300 |

| Mouse – Cordless | 49 Pcs | 500 | 24500 |

| IGST | 11664 | ||

| 150 Pcs | 76464 |

Check Reports

Display More Report > Statement of Accounts > Outstanding > Receivable/ Payables

Balance Sheet

Receive Amount against Sale

Gateway of Tally > Voucher > F6 (Receipt)

Account : Cash

Cr Sudhir Saini : 2242

Accept

Account : SBI Bank

Cr Sanju Rawat : 76464

Accept

Make Payment to Supplier

Gateway of Tally > Voucher > F5 (Payment)

Account : Cash

Super Computer Store (Dr): 1699.20

Accept

Account : SBI Bank

Dr Delhi Computer Traders : 76464

Accept

Report

Balance Sheet > Current Liabilities

Duties and Taxes : 4636.80

CGST : 41.40

IGST : 4554.00

SGST : 41.40

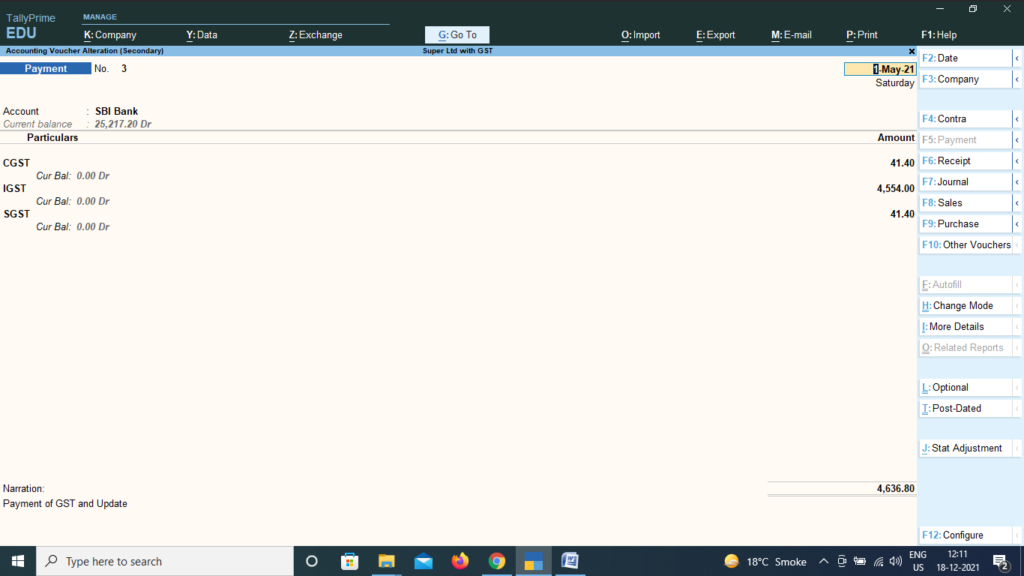

Pay GST and Update in Tally Prime

Gateway of Tally > Vouchers >Payment (F5)

Change Date F2 – 1.5.2021 ( For Tally training version)

Account -SBI Bank

CGST : 41.40

SGST : 41.40

IGST : 4554.00

Total : 4636.80

Mode of Payment : Net banking /

Name of Bank : SBI

Check Balance Sheet > Current Liabilities > Duties and Taxes – NIL

Tally Prime Course Notes PDF Download

Download Tally Computer Course Notes and Practice Assignment Bill Book PDF :