Tally Prime Book PDF with GST and Payroll for Free Download. Complete Step by Step Training Guide, with practice assignment for Tally computer course. Notes PDF are very useful to learn Tally for self business and work as Tally operator.

About the Tally Prime Book PDF

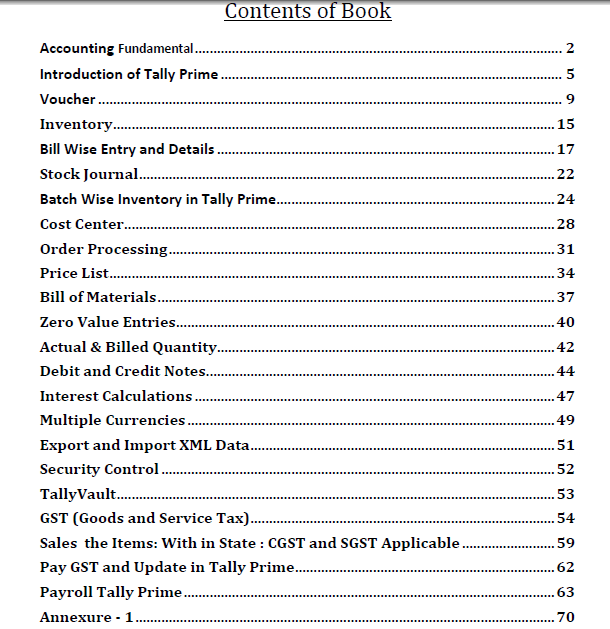

There are total 11 parts PDF parts of this Tally Prime book. 9 Pars PDF cover all the relevant topics and 2 Annexure of Bill books. All the parts of Tally Prime Book PDF are provided below for free download.

Book Name: Tally Prime with GST and Payroll

Author : Ajay Gulia

Super Success Institute, Muzaffarnagar

Accounting Fundamental and Introduction of Tally Prime

Golden Rules of Accounting

Manual Accounting and entries

Introduction of Tally Prime

Create, Alter and Delete a Company

Pre Defined Groups

Create new Groups, Ledger and vouchers

Voucher mode entries

Inventory of Items

Create Stock Group and Items

Bill Wise Entry and Details

Bill Book for Practice Entry

Stock Journal

Create Godown / Location

Transfer of Materials

Download : Bill Book PDF

Batch Wise Inventory in Tally Prime

Batch wise details required for Trading of Items with Expiry date. For Example Medicine, packed editable items etc.

Cost Center, Order Processing, Price List and BOM

Create Cost centers, Book the Amount

Place a Purchase and Sale order and Voucher entry

Create Price List for wholesaler and retail customer

Manufacture a item from the raw material, Purchase raw material, Costing of manufactured item. Bill of Materials example for a computer manufacture unit.

Zero Value Entries and Actual and Billed Quantity

Activate Zero Value Transaction

Actual & Billed Quantity Column in bill

Debit and Credit Notes

Purchase Return : Debit Notes

Sales Return : Credit Notes

Interest Calculations for Sundry Debtors

Multiple Currencies for purchase and sale in foreign currency

Security of Data and Import Export

Export and Import XML Data

Security Control

TallyVault

GST (Goods and Service Tax) in Tally Prime

Activate GST

Create Ledgers for GST

Ledger for Purchase Party

Ledger for Sales Party

Stock Group Creation

Create Unit

Create Stock Items with GST

Purchase the Items

Sales the Items: With in State : CGST and SGST Applicable

Sales the Items: Other State : CGST and SGST Applicable

Receive Amount against Sale

Make Payment to Supplier

Pay GST and Update in Tally Prime

Download Tally Computer Course Notes and Practice Assignment Bill Book PDF :

Download : Bill book with GST

Payroll Tally Prime : PDF Free Download

Create a New Company :

Add Capital in Company

Create Employees Group

Create Units (Work)

Attendance / Production Type

Create Pay Heads

Name :Basic Pay

HRA

DA

Transport Allowance (TA)N

Bonus

Provident Funs (PF)Na

ESIC

Over Time

Create Employees

Payroll Vouchers

Attendance Boucher Creation

Payroll Boucher Creation

Display the Salary Information

Thanks for study the Tally Prime notes and free download Tally Prime Book PDF.

Tally Prime Full Course Notes with Assignment

You may write your comment at below box for for any query, doubt and assistance.

I can not open the Pdf No.6

😭😭😭😭

Very useful content for practice,

and if you could also share the answers through reports for “GST bill entry” we could check if our entries are correct.

Thanking you

vary helpful . thank you

I Can’t Open Payroll

THIS IS SUPER SUPPORT TO ANY FACULTY OR STUDENT WORK SUPPORT IN ONLINE

MAY GOD BLESS YOU

IT IS VERY USEFUL FOR TALLY BEGINERS TO LEARN TALLY WITH THE HELP OF THIS PDF BOOK.