Tally ERP 9 GST notes book pdf for free download. Notes are very useful for students learning Tally at Computer Coaching Classes. In the document all the details from the Activating Tally In Running Company, GST Tax Ledger and Where To Activate GST Rates are explained with screen shots.

Contents of Notes

Activating Tally In Running Company

Care to be taken while Activating GST in Running company

Requirements

Create a company with GST

Account Masters creation / Updating

Stock Master creation / Updating

Creating Ledgers for GST

Where and how to activate rates for GST

How To Pass Entries in tally for GST

Generate of Returns 1 and 2

Need to Allocate all Debtors and Creditors on Bill wise basis , ( Also Non Trading Items ).

Find out HSN and ASC code applicable to your company good and services

Obtain all Details like Address , State , Country / GST no of all your Debtors and Creditors and update in Master

Find out Debtor / Creditor Type Registered / Unregister / Composite / Consumer / Exporter / SEZ or E commerce operator

If you have multiple locations and different GST No Then Accounts need to be split

Now you can not maintain books in one tally company ,Two or More companies per GST need to be maintained

But Your companies multiple location can be maintained with one GSTN no.

And you can maintain ledger for Debtors and Creditors with multiple locations also.

Official License is required if not then renew Tally TSS

If very old version of tally

Then upgrade first to any version Tally ERP 9 5.x

Then Migrate to Ver 6.0.1

And Open Each Company in the new Version

Split the company ( Its Optional )

See Display Menu > List of Accounts > See the Total Ledgers / Group available in Company

CNTR + I > check the stock Items available in company

Take the printout of TB as on 30.06.2017 before you split the company

Delete unnecessary Ledgers and groups

Delete unwanted stock items

Is it necessary to integrate stock with accounts

Best if you integrate

( optional ) if you want.

Benefits also and problems also

CA or Client need to take call on this issue

Entries with all voucher types i.e Sales /

Purchase / Debit / Credit Notes , etc

Is it necessary to integrate stock with accounts

Best if you integrate

( optional ) if you want.

Benefits also and problems also

CA or Client need to take call on this issue

Entries with all voucher types i.e Sales / Purchase / Debit / Credit Notes , etc

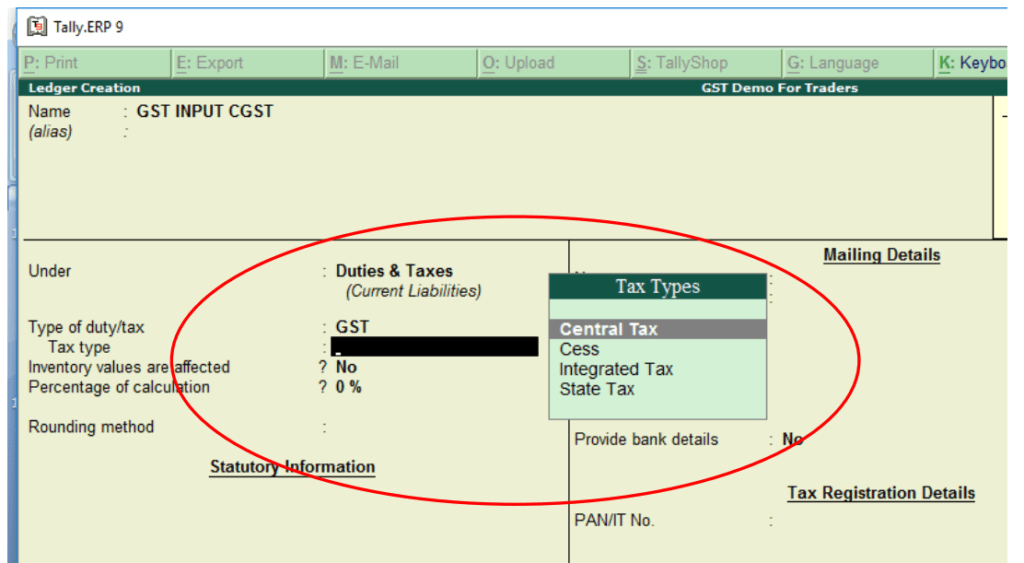

GST Tax Ledger

No Need to Have Separate tax ledger for Input

and Output

But Suggested to have better control in accounts

Must have 3 Ledgers

CGST

SGST

IGST

Under Duties and taxes > GST

No Need to specify tax amount here also

Where To Activate GST Rates

There are various method to activate tax rates in tally

- At creation of company

- At Purchase / Sales Ledger ( Suggested For Services )

- Stock group level

- At stock item level ( Suggested For Goods )

Tally ERP 9 with GST Notes PDF Download

By- JSS Associates

Quality of PDF – Very Good

Number of PDF Pages : 62

Tally Computer Training Notes

Number of Pages : 49

Download Tally Computer Course Training Notes PDF from the below link.

Tally Prime Full Course Notes

Tally Prime Book PDF Free Download